India remains one of the world’s largest oil importers, with over 85% of its crude oil requirement met through imports. In 2025, India continued to import around 240 million tons of crude oil annually, making it the third largest importer globally. This heavy reliance on foreign oil makes India vulnerable to global market volatility, especially as trade sanctions imposed on key oil producers such as Russia, Iran, and Venezuela tighten amidst geopolitical tensions. Disruptions in supply, fluctuating prices, and growing compliance complexities are pressing challenges that directly impact India’s fuel costs, inflation rates, and economic growth. Yet, India is actively adapting, deploying strategic responses to ensure long-term energy security and economic resilience.

5 Ways Trade Sanctions Are Rocking India’s Oil Import Scene

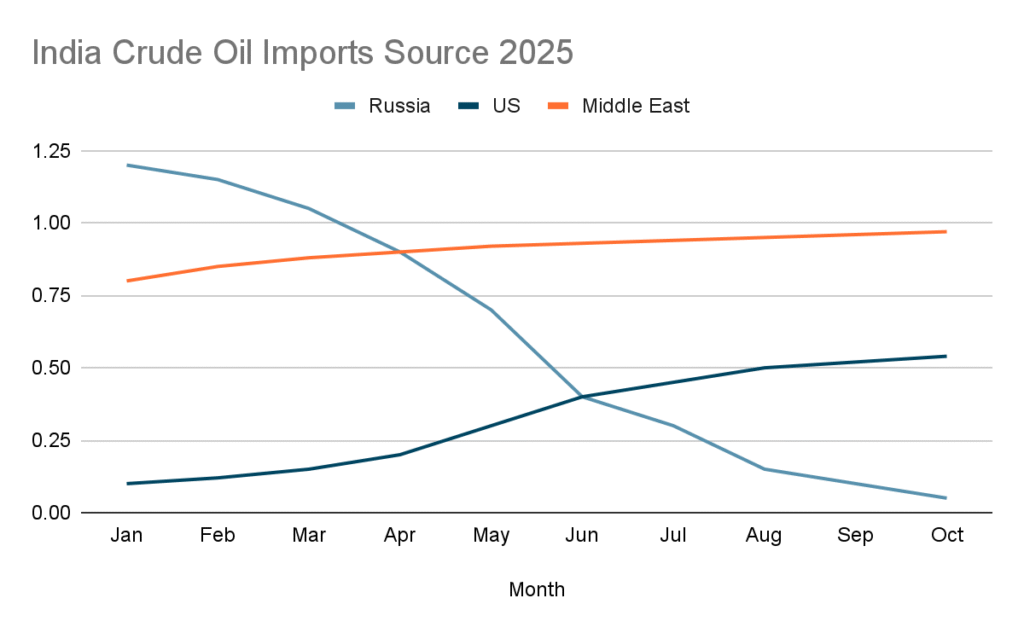

- Supply Chain Disruption: Sanctions on major suppliers force India to pivot procurement strategies, leading to increased logistical costs and delays. For instance, India’s imports of Russian crude, which previously constituted a significant share, have plummeted by over 50% in 2025 after US sanctions on companies like Rosneft and Lukoil, compelling Indian refiners to seek supplies from the Middle East, the US, Brazil, and Africa.

- Price Volatility and Inflation Pressure: Reduced global oil supplies narrow availability, causing sharp price surges. India’s average crude oil price fell in early 2025 but remains susceptible to spikes due to geopolitical instability. These surges escalate the cost of transportation, manufacturing, and agriculture, fueling inflation that burdens households and businesses alike.

- Widening Trade Deficit: Increased spending on costlier imports expands India’s trade deficit. Crude import bills rose from $156.3 billion in FY24 to $161 billion in FY25 despite some price relief, exacerbating pressure on foreign exchange reserves. This impacts currency stability and can trigger tighter fiscal and monetary policies.

- Compliance Complexities: Navigating intricate sanction laws involves financial freezes and legal risk management for banks and companies. India’s approach has been careful compliance to avoid secondary sanctions, as seen in its earlier cessation of oil imports from Iran and Venezuela under US pressure.

- Geopolitical Vulnerabilities: Overdependence on sanctioned regions constrains India’s negotiating power, limiting supply diversification options and exposing the economy to global political shifts.

4 Bold Moves Fueling India’s Resilience

- Diversifying Oil Sources: India dramatically increased crude oil imports from the US by over 50% in the first half of 2025, reaching around 540,000 barrels per day by October. Imports from Brazil surged 80% year-on-year. Indian refiners are also boosting purchases from Iraq, UAE, and other Middle Eastern countries, balancing supply risks with commercial and diplomatic considerations.

- Boosting Domestic Production: Although domestic crude production declined slightly to 28.7 million tons in FY25, investments in exploration, drilling technologies, and refining have been prioritized to reduce import dependency gradually. Enhanced refining capacity allows India to process a broader range of crude grades efficiently.

- Accelerating Renewable Energy Adoption: India’s commitment to renewables is a cornerstone of its energy strategy. Expanding solar, wind, and biofuel projects alongside electric mobility helps reduce vulnerability to fossil fuel market volatility and supports sustainable economic growth.

- Building Strategic Reserves and Refining Capacity: India’s strategic petroleum reserves now provide several weeks’ worth of crude stockpile, cushioning supply shocks. Refinery upgrades increase flexibility to handle diverse crude inputs, ensuring steady fuel availability amid import disruptions.

Economic and Social Implications for India

Sanctions driven shifts in oil import patterns and prices affect all layers of society. Rising petrol and diesel prices inflate transportation costs, increasing the cost of goods and services. Agriculture, heavily reliant on fuel and fertilizers, sees rising production costs, impacting food prices. For the average consumer, household budgets tighten as inflation pressures intensify, potentially slowing India’s target of 7% GDP growth in the short term. Despite these challenges, India’s proactive diversification and clean energy pivot offer hope for stabilizing energy access and economic prospects.

Conclusion: Embracing a Resilient Energy Future

India’s oil import scenario in 2025 vividly illustrates the complex interplay between global geopolitics, economic pressures, and national energy policy. While trade sanctions disrupt traditional supply chains and raise costs, India’s adaptive measures like diversification, domestic capacity building, renewables adoption, and strategic reserves are transforming vulnerabilities into strengths. This multifaceted approach not only mitigates immediate risks but also aligns with India’s vision of a sustainable, secure, and prosperous energy future. Supporting these efforts through continued innovation, investment, and policy coherence is vital to ensuring energy stability and economic resilience for millions of Indians in the years ahead.